How to Trade with Exness: Your Step-by-Step Guide to Getting Started

Exness has built a strong reputation as a reliable and user-friendly broker, making it a popular choice for traders worldwide. If you're looking to dive into the world of online trading with Exness, this guide will walk you through everything you need to know, from setting up your account to executing your first trade.

Step 1: Open an Exness Account

Your trading journey begins here. Exness offers a straightforward account opening process.

* Visit the Exness Website: Go to the official Exness website. Be cautious of fraudulent sites and always double-check the URL.

* Click "Open Account" or "Register": You'll typically find prominent buttons for this on the homepage.

* Provide Your Details:

* Country of Residence: Select your country (e.g., Laos, as per our current location).

* Email Address: Use a valid email you actively check.

* Password: Create a strong, unique password.

* Complete Verification: This is a crucial step for security and regulatory we compliance.

* Verify Email/Phone: You'll receive a verification code via email or SMS.

* Personal Information: Fill in your full name, date of birth, and address.

* Proof of Identity (POI): Upload a clear photo of a government-issued ID (passport, national ID card, driver's license).

* Proof of Residence (POR): Upload a document showing your address (utility bill, bank statement) dated within the last 3-6 months.

* Economic Profile: Answer a few questions about your trading experience and financial situation.

Why is verification important? It protects both you and the broker from fraud and ensures compliance with financial regulations.

Step 2: Choose Your Account Type

Exness offers various account types designed to suit different trading styles and experience levels. Take your time to understand them:

* Standard Account: Ideal for beginners. It has a low minimum deposit, no commissions, and competitive spreads. It's a great starting point to get familiar with the platform and market.

* Standard Cent Account: Perfect for absolute beginners who want to trade with very small volumes (in cents) to minimize risk while learning.

* Professional Accounts (Pro, Zero, Raw Spread): These are designed for experienced traders. They typically offer tighter spreads, but may involve commissions per trade (for Zero and Raw Spread accounts). The Pro account offers commission-free trading with very low spreads.

Considerations when choosing:

* Your trading capital: How much are you willing to deposit?

* Your trading style: Are you a scalper, day trader, or swing trader?

* Your experience level: Are you a complete novice or an experienced pro?

You can open multiple accounts later if your needs change.

Step 3: Fund Your Trading Account

* Log in to your Personal Area (PA): This is your dashboard where you manage your accounts.

* Click "Deposit": You'll see a list of available payment methods.

* Select Your Preferred Method: Options commonly include:

* Bank cards (Visa/Mastercard)

* E-wallets (Skrill, Neteller, Perfect Money, Sticpay, etc.)

* Local payment methods (which vary by region, but are very popular in Asia)

* Bank transfers

* Cryptocurrencies (e.g., USDT, BTC)

* Enter Amount and Confirm: Follow the prompts to complete the transaction.

Exness often prides itself on instant deposits, meaning your funds should appear in your trading account almost immediately.

Step 4: Download and Install Your Trading Platform

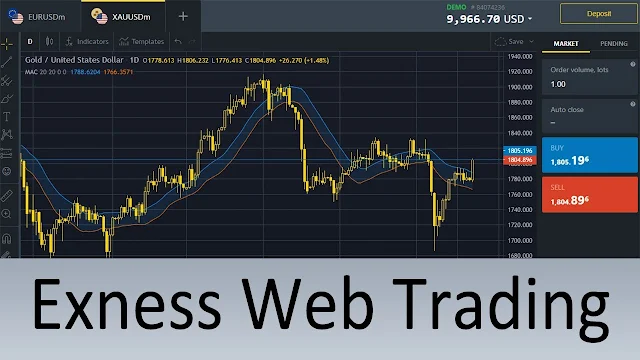

Exness supports the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). They also offer their proprietary Exness Terminal (web-based) and the Exness Trade Mobile App.

* Navigate to the "Platforms" section in your PA: You'll find download links here.

* Choose Your Platform:

* MetaTrader 4 (MT4): The industry standard, known for its stability, wide range of indicators, and Expert Advisors (EAs). Great for forex trading.

* MetaTrader 5 (MT5): An upgraded version offering more timeframes, more indicators, and the ability to trade more asset classes (like stocks and indices).

* Exness Trade App: Excellent for mobile trading on the go, with a very intuitive interface.

* Exness Terminal: A web-based platform, no download required, perfect for quick access from any browser.

* Download and Install: Follow the instructions for your chosen platform.

* Log in to the Platform: Use your trading account number (not your PA login email) and the password you set for that specific trading account. Select the correct Exness server.

Step 5: Understand the Trading Interface

Before placing a trade, familiarize yourself with your chosen platform:

* Market Watch/Symbols: A list of tradable instruments (currency pairs, commodities, indices, etc.) and their current bid/ask prices.

* Charts: Visual representation of price movements over time. You can customize timeframes, add indicators, and draw analysis tools.

* Navigator/Accounts (MT4/5): Where you manage your accounts, indicators, and Expert Advisors.

* Terminal/Toolbox (MT4/5): Shows your open trades, pending orders, account balance, equity, margin, and trading history.

* Order Window: Where you input the details of your trade (volume, stop loss, take profit).

Step 6: Learn Basic Trading Concepts

You don't need to be an expert overnight, but understanding the basics is crucial:

* Pips: The smallest unit of price movement in forex.

* Lots: The unit of volume you trade. A standard lot is 100,000 units of the base currency. You can also trade mini lots (10,000) and micro lots (1,000).

* Leverage: Allows you to control a larger position with a smaller amount of capital. Be cautious, as it amplifies both profits and losses.

* Margin: The amount of money required to open and maintain a leveraged position.

* Bid/Ask Prices: The price at which you can sell (Bid) or buy (Ask) an instrument. The difference is the spread.

* Stop Loss (SL): An order to close a trade automatically when the price reaches a certain level, limiting potential losses. Always use a Stop Loss!

* Take Profit (TP): An order to close a trade automatically when the price reaches a certain level, securing profits.

Step 7: Conduct Market Analysis

Successful trading involves understanding why prices move. There are two main types of analysis:

* Technical Analysis: Studying past price charts and patterns to predict future movements. This involves using indicators (moving averages, RSI, MACD), support/resistance levels, and candlestick patterns.

* Fundamental Analysis: Analyzing economic news, political events, and other factors that influence the supply and demand of assets. Keep an eye on economic calendars for major announcements.

Step 8: Place Your First Trade!

Now for the exciting part!

* Choose Your Instrument: In the Market Watch, double-click the currency pair or asset you want to trade (e.g., EUR/USD).

* Open the Order Window: A new window will pop up.

* Set Your Volume (Lots): Decide how many lots you want to trade. Start small, especially as a beginner (e.g., 0.01 micro lot).

* Set Stop Loss (SL) and Take Profit (TP): Crucial for risk management. Input the price levels where you want your trade to automatically close.

* Choose Buy or Sell:

* Buy (Long): If you expect the price to rise.

* Sell (Short): If you expect the price to fall.

* Click "Buy" or "Sell": Your trade will be executed!

You'll see your open trade in the "Terminal" or "Toolbox" window, where you can monitor its progress, modify SL/TP, or close it manually.

Step 9: Monitor and Manage Your Trades

Once a trade is open, it's essential to monitor it:

* Check Profit/Loss: Keep an eye on how your trade is performing.

* Adjust SL/TP: You might want to move your Stop Loss to break-even as your trade moves into profit (trailing stop).

* Partial Close: You can close part of your position to lock in some profits while letting the rest run.

* Don't Over-trade: Avoid taking too many trades simultaneously, especially when starting out.

Step 10: Practice and Learn Continuously

Trading is a skill that improves with practice.

* Start with a Demo Account: Exness offers free demo accounts with virtual money. This is the best way to practice strategies and get comfortable with the platform without risking real capital.

* Utilize Exness Educational Resources: Exness provides various educational materials, webinars, and articles.

* Review Your Trades: After each trade, analyze what went right and what went wrong. Learn from your mistakes.

* Stay Informed: Keep up with market news and economic events.

Important Trading Tips for Exness Traders:

* Risk Management is King: Never risk more than a small percentage (e.g., 1-2%) of your capital on a single trade.

* Start Small: Begin with a low deposit and small trade volumes.

* Develop a Trading Plan: Define your entry/exit rules, risk tolerance, and goals.

* Emotional Control: Don't let fear or greed dictate your trading decisions.

* Understand Leverage: While Exness offers high leverage, use it wisely. It can amplify losses as much as profits.

Trading with Exness is a rewarding experience when approached with knowledge and discipline. By following these steps and committing to continuous learning, you'll be well on your way to navigating the financial markets successfully. Good luck!

Join the conversation